Harmonisation of state aid rules for research and development and innovation

As part of the activities in areas covered by the Negotiating Chapter 8, the PLAC III project has provided support to the Commission for State Aid Control in harmonising state aid schemes in the fields of research and development and innovation with EU rules.

The support included an analysis of the existing state aid schemes in Serbia, a comparative analysis with the state aid for research, development and innovation in the EU, as well as recommendations for harmonisation.

Project expert Olgica Spevec presented the results of the work – a proposal of Guidelines for further harmonisation of state aid schemes in research and development and innovation with EU rules at the workshop held on 2 March 2022. The workshop was attended by members of the State Aid Control Commission.

Spevec presented the Community framework for State aid for research and development and innovation, which contains the conditions for assessing the compatibility of State aid subject to notification to the European Commission in case of intention to grant state aid exceeding the financial “thresholds” for which general block exemptions are prescribed. She also stated that new types of state aid have been in force since August 2021, as an addition to financing certain activities from the Horizon 2020 and Horizon Europe programmes. This is made possible by the amendments to Regulation 651/2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108.

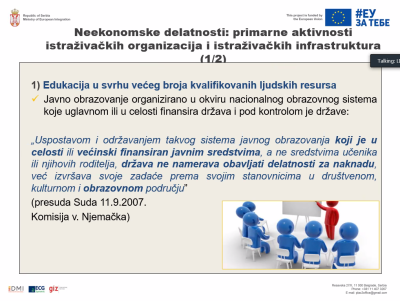

State aid for research and development and innovation in the EU may be granted on the basis of paragraph 3 of Article 107 of the Treaty on the Functioning of the EU as State aid to facilitate the development of certain economic activities in the Union.

If the infrastructure of a research organisation is used to carry out both non-economic and economic activities (such as renting laboratories, providing contract research services, etc.), the organisation’s public funding is subject to state aid rules only to the extent that it covers costs related to economic activity.

If a scientific (research) organisation conducts contract research, it is an economic activity and the rules on state aid are applied to public financing of that activity. Recipients of state aid are end-users to whom the benefits of public funding are transferred (technology parks, innovative small and medium-sized enterprises, etc.)

In Serbia, the conditions and criteria for the harmonisation of state aid for research and development and innovation are contained in the Regulation on the conditions and criteria for the harmonisation of horizontal state aid. The Law on Innovation Activities envisages the establishment of economic incentive measures for the subjects of the innovation system and stimulating procedures and procedures in favour of those subjects by the competent authorities, the autonomous province, local self-government and legal entities managing public funds, which is the legal basis for state aid.

The proposed Guidelines on further harmonisation on state aid schemes include a recommendation to separate the economic and non-economic activities of research organisations and higher education institutions. Also to prevent cross-subsidization of economic activity from public funds intended for the performance of their basic non-economic activity. The Science Fund should establish a system by which it clearly regulates its activities in different situations, i.e. when it is a provider of state aid, a mediator in the allocation of public funds and state aid and a recipient of state aid.

Relevant Union acquis

Photo gallery

Recent Posts

Notice

9. April 2024.

The fourth project brochure published

29. March 2024.

The last meeting of the Steering Committee

28. March 2024.

Negotiation chapters

- Chapter 1: Free movement of goods

- Chapter 3: Right of establishment and freedom to provide services

- Chapter 8: Competition policy

- Chapter 9: Financial services

- Chapter 10: Information society and media

- Chapter 11: Agriculture and rural development

- Chapter 12: Food safety, veterinary and phytosanitary policy

- Chapter 13: Fisheries

- Chapter 15: Energy

- Chapter 16: Taxation

- Chapter 27: Environment

- Chapter 28: Consumer and health protection

- Chapter 32: Financial control

- Chapter 33: Financial and budgetary provisions