Administrative Cooperation in taxation

Within the project activities in the area of Negotiation Chapter 16 (Taxation), PLAC III project has provided support to the Tax Administration of Serbia’s Ministry of Finance in improving the work and capacities in order to enable exchange of information in the field of taxation with EU Member States and members of the Organisation for Economic Cooperation and Development (OECD).

One of the main elements of tax reforms in Serbia is to introduce a modern, advanced tax systems in line with systems in EU Member States and other OECD countries.

The tax cooperation in the EU requires effective exchange of information and mutual assistance between the Member States’ tax authorities, especially for intra-community transactions in VAT, excise duties and direct taxation. Administrative structures such as the Central Liaison Office (CLO) and the Excise Liaison Office (ELO) must be created to process the information, enable the cooperation and channel the assistance requests.

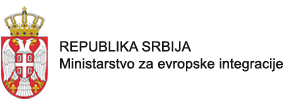

From the date of accession, Serbia needs to fulfill all requirements of the Administrative Cooperation Directives (DAC) 2011/16/EU , 2014/107/EU, 2015/2376/EU, 2016/881/EU, 2016/2258/EU, 2018/822/EU, the VAT Regulation 904/2010 and the Excise Regulations 389/2012, 612/2013 and 389/2012, in particular concerning exchange of information on request, spontaneous and mandatory automatic exchange of information with all the Member States and other forms of administrative cooperation as foreseen by the legislation.

Tax Administration has established an organisational unit for the ELO that will act as a future Central Liaison Office.

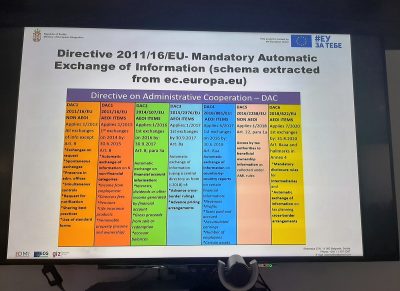

The expert support of PLAC III project included work with representatives of the Tax Administration and transferring know-how in the field of information exchange, analysis of the existing legal framework and recommendations for the establishment of the CLO. Project expert Ernst Radlwimmer presented the legal basis that enables the exchange of information in the EU, as well as Austria’s experience as an EU Member State at a workshop held on 11 June 2021 for representatives of the Tax Administration. Mandatory exchange of information between tax administrations is set by Directive 2011/16 EU (DAC 1) on administrative cooperation in the field of taxation, which must be transposed into national legislation. The directive has had several amendments so far, from DAC 1 to DAC 6 and these are new legal obligations that Member States must implement. DAC 7 was adopted in 2021 and relates to the exchange of information across digital platforms.

Radlwimmer conveyed a list of recommendations for Serbia which, among other things, include that requests for implementation of standards should arrive at one place in the Ministry of Finance from where they would be submitted to the Tax Administration, as well as to conduct administrative investigations within the Administration itself. All of these must be accompanied by human resources improvement and adequate IT system.

Directive 2010/24/EU on mutual assistance for the recovery of claims relating to taxes, duties and other measures must be fully transposed, while Regulation 904/2010 on administrative cooperation and combating fraud in the field of value added tax allows for the creation of EUROFISC as a system for preventing fraud by exchanging information between Member States.

Cover photo: Audiovisual service, European Commission

Relevant EU legislation:

Photo gallery

Recent Posts

Notice

9. April 2024.

The fourth project brochure published

29. March 2024.

The last meeting of the Steering Committee

28. March 2024.

Negotiation chapters

- Chapter 1: Free movement of goods

- Chapter 3: Right of establishment and freedom to provide services

- Chapter 8: Competition policy

- Chapter 9: Financial services

- Chapter 10: Information society and media

- Chapter 11: Agriculture and rural development

- Chapter 12: Food safety, veterinary and phytosanitary policy

- Chapter 13: Fisheries

- Chapter 15: Energy

- Chapter 16: Taxation

- Chapter 27: Environment

- Chapter 28: Consumer and health protection

- Chapter 32: Financial control

- Chapter 33: Financial and budgetary provisions